Craig Hallum upgraded shares of NVIDIA (NASDAQ:NVDA) from a hold rating to a buy rating in a research report sent to investors on Friday, Briefing.com Automated Import reports. They currently have $255.00 price objective on the computer hardware maker’s stock.

Craig Hallum upgraded shares of NVIDIA (NASDAQ:NVDA) from a hold rating to a buy rating in a research report sent to investors on Friday, Briefing.com Automated Import reports. They currently have $255.00 price objective on the computer hardware maker’s stock.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.

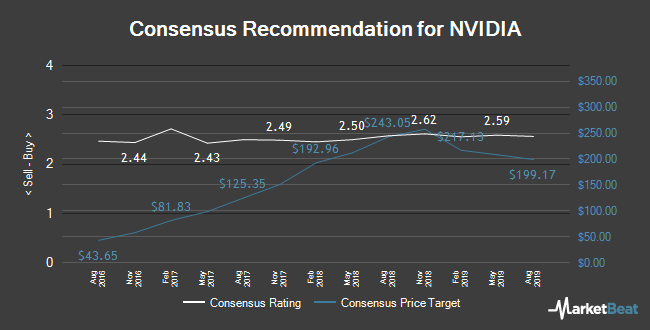

Other equities research analysts have also issued reports about the company. Rosenblatt Securities reaffirmed a buy rating and set a $180.00 target price on shares of NVIDIA in a research report on Friday, August 16th. DZ Bank lowered NVIDIA from a hold rating to a sell rating and set a $158.00 price target for the company. in a research report on Friday, September 13th. Wells Fargo & Co boosted their price target on NVIDIA from $220.00 to $240.00 and gave the stock an outperform rating in a research report on Friday. Needham & Company LLC reissued a sell rating on shares of NVIDIA in a research report on Friday, August 16th. Finally, FBN Securities set a $190.00 price target on NVIDIA and gave the stock a buy rating in a research report on Friday, August 16th. Three analysts have rated the stock with a sell rating, thirteen have issued a hold rating and twenty-seven have issued a buy rating to the stock. The company presently has an average rating of Buy and an average target price of $216.69.

NASDAQ NVDA traded down $4.11 on Friday, reaching $208.17. 658,581 shares of the stock traded hands, compared to its average volume of 8,276,448. The company has a debt-to-equity ratio of 0.22, a quick ratio of 7.71 and a current ratio of 8.42. The company has a fifty day moving average price of $195.53 and a 200-day moving average price of $170.83. The company has a market cap of $124.96 billion, a price-to-earnings ratio of 34.27, a PEG ratio of 5.25 and a beta of 2.06. NVIDIA has a 12 month low of $124.46 and a 12 month high of $213.35.

NVIDIA (NASDAQ:NVDA) last issued its earnings results on Thursday, November 14th. The computer hardware maker reported $1.78 earnings per share for the quarter, beating the Zacks’ consensus estimate of $1.57 by $0.21. The business had revenue of $3.01 billion during the quarter, compared to analyst estimates of $2.92 billion. NVIDIA had a return on equity of 22.02% and a net margin of 24.08%. NVIDIA’s revenue was down 5.2% on a year-over-year basis. During the same period in the previous year, the company posted $1.84 EPS. As a group, research analysts anticipate that NVIDIA will post 4.07 earnings per share for the current fiscal year.

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 20th. Investors of record on Friday, November 29th will be paid a dividend of $0.16 per share. The ex-dividend date is Wednesday, November 27th. This represents a $0.64 annualized dividend and a yield of 0.31%. NVIDIA’s dividend payout ratio (DPR) is 10.54%.

In other NVIDIA news, CFO Colette Kress sold 31,357 shares of the business’s stock in a transaction dated Thursday, September 19th. The stock was sold at an average price of $179.01, for a total transaction of $5,613,216.57. The transaction was disclosed in a filing with the SEC, which is accessible through this hyperlink. Also, Director Michael G. Mccaffery sold 15,000 shares of the business’s stock in a transaction dated Tuesday, August 27th. The shares were sold at an average price of $165.97, for a total value of $2,489,550.00. Following the sale, the director now owns 27,579 shares in the company, valued at approximately $4,577,286.63. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 63,883 shares of company stock worth $11,206,817. 4.64% of the stock is owned by company insiders.

A number of institutional investors have recently bought and sold shares of the business. New England Investment & Retirement Group Inc. boosted its stake in shares of NVIDIA by 2.0% in the third quarter. New England Investment & Retirement Group Inc. now owns 2,625 shares of the computer hardware maker’s stock worth $457,000 after buying an additional 52 shares during the last quarter. Parkside Financial Bank & Trust boosted its stake in shares of NVIDIA by 5.2% in the third quarter. Parkside Financial Bank & Trust now owns 1,131 shares of the computer hardware maker’s stock worth $197,000 after buying an additional 56 shares during the last quarter. First Personal Financial Services boosted its stake in shares of NVIDIA by 16.0% in the third quarter. First Personal Financial Services now owns 413 shares of the computer hardware maker’s stock worth $72,000 after buying an additional 57 shares during the last quarter. Gemmer Asset Management LLC boosted its stake in shares of NVIDIA by 26.1% in the third quarter. Gemmer Asset Management LLC now owns 285 shares of the computer hardware maker’s stock worth $50,000 after buying an additional 59 shares during the last quarter. Finally, PFG Advisors boosted its stake in shares of NVIDIA by 2.5% in the third quarter. PFG Advisors now owns 2,579 shares of the computer hardware maker’s stock worth $466,000 after buying an additional 63 shares during the last quarter. Institutional investors and hedge funds own 64.56% of the company’s stock.

NVIDIA Company Profile

NVIDIA Corp. engages in the design and manufacture of computer graphics processors, chipsets, and related multimedia software. It operates through the Graphics Processing Unit (GPU) and Tegra Processor segments. The GPU segment comprises of product brands which aims specialized markets including GeForce for gamers; Quadro for designers; Tesla and DGX for AI data scientists and big data researchers; and GRID for cloud-based visual computing users.

Featured Article: What is the QQQ ETF?