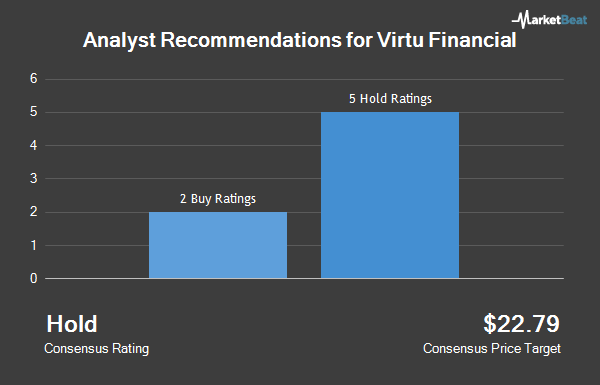

Shares of Virtu Financial Inc (NASDAQ:VIRT) have received a consensus recommendation of “Hold” from the eleven brokerages that are currently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell rating, five have assigned a hold rating and four have given a buy rating to the company. The average 1-year price target among analysts that have updated their coverage on the stock in the last year is $21.50.

Shares of Virtu Financial Inc (NASDAQ:VIRT) have received a consensus recommendation of “Hold” from the eleven brokerages that are currently covering the firm, Marketbeat reports. One investment analyst has rated the stock with a sell rating, five have assigned a hold rating and four have given a buy rating to the company. The average 1-year price target among analysts that have updated their coverage on the stock in the last year is $21.50.

Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.

A number of research firms recently commented on VIRT. Compass Point set a $18.00 target price on Virtu Financial and gave the stock a “hold” rating in a research report on Wednesday, October 9th. Morgan Stanley decreased their price objective on Virtu Financial from $20.00 to $19.00 and set an “equal weight” rating on the stock in a research report on Tuesday, October 8th. UBS Group downgraded Virtu Financial from a “buy” rating to a “neutral” rating and decreased their price objective for the company from $21.00 to $17.00 in a research report on Friday, November 8th. ValuEngine upgraded Virtu Financial from a “sell” rating to a “hold” rating in a research report on Friday, October 11th. Finally, JPMorgan Chase & Co. restated an “overweight” rating and set a $23.00 price objective on shares of Virtu Financial in a research report on Tuesday, September 3rd.

In other Virtu Financial news, CEO Douglas A. Cifu purchased 20,000 shares of Virtu Financial stock in a transaction dated Thursday, November 7th. The shares were purchased at an average cost of $16.24 per share, for a total transaction of $324,800.00. Following the completion of the acquisition, the chief executive officer now owns 255,000 shares in the company, valued at approximately $4,141,200. The acquisition was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, CEO Douglas A. Cifu purchased 10,000 shares of Virtu Financial stock in a transaction dated Wednesday, September 4th. The stock was acquired at an average price of $18.58 per share, for a total transaction of $185,800.00. Following the completion of the acquisition, the chief executive officer now owns 235,000 shares of the company’s stock, valued at approximately $4,366,300. The disclosure for this purchase can be found here. Corporate insiders own 63.70% of the company’s stock.

Hedge funds and other institutional investors have recently modified their holdings of the company. Yorktown Management & Research Co Inc purchased a new stake in shares of Virtu Financial in the second quarter worth approximately $453,000. First Bank & Trust raised its holdings in shares of Virtu Financial by 7.2% in the third quarter. First Bank & Trust now owns 15,956 shares of the financial services provider’s stock worth $261,000 after buying an additional 1,069 shares during the period. Bangor Savings Bank raised its holdings in shares of Virtu Financial by 24.9% in the second quarter. Bangor Savings Bank now owns 46,266 shares of the financial services provider’s stock worth $1,008,000 after buying an additional 9,227 shares during the period. Janney Montgomery Scott LLC raised its holdings in shares of Virtu Financial by 8.8% in the third quarter. Janney Montgomery Scott LLC now owns 166,840 shares of the financial services provider’s stock worth $2,730,000 after buying an additional 13,558 shares during the period. Finally, Tiverton Asset Management LLC purchased a new stake in shares of Virtu Financial in the second quarter worth approximately $1,222,000. Hedge funds and other institutional investors own 65.92% of the company’s stock.

Shares of NASDAQ:VIRT traded up $0.09 during mid-day trading on Friday, reaching $16.62. The stock had a trading volume of 24,649 shares, compared to its average volume of 785,583. The company has a current ratio of 0.72, a quick ratio of 0.72 and a debt-to-equity ratio of 1.78. The company has a market cap of $3.18 billion, a P/E ratio of 8.53, a price-to-earnings-growth ratio of 4.09 and a beta of -0.55. Virtu Financial has a 1 year low of $15.32 and a 1 year high of $29.17. The business’s 50 day moving average price is $16.58 and its 200 day moving average price is $20.02.

Virtu Financial (NASDAQ:VIRT) last posted its earnings results on Tuesday, November 5th. The financial services provider reported $0.21 EPS for the quarter, hitting analysts’ consensus estimates of $0.21. The company had revenue of $245.00 million for the quarter, compared to the consensus estimate of $241.79 million. Virtu Financial had a return on equity of 18.75% and a net margin of 2.55%. The firm’s revenue for the quarter was up 37.7% on a year-over-year basis. During the same period in the previous year, the business earned $0.22 earnings per share. Analysts predict that Virtu Financial will post 0.82 earnings per share for the current fiscal year.

The business also recently disclosed a quarterly dividend, which will be paid on Monday, December 16th. Shareholders of record on Monday, December 2nd will be given a dividend of $0.24 per share. The ex-dividend date is Friday, November 29th. This represents a $0.96 dividend on an annualized basis and a yield of 5.78%. Virtu Financial’s dividend payout ratio (DPR) is presently 48.98%.

Virtu Financial Company Profile

Virtu Financial, Inc, together with its subsidiaries, provides market making and liquidity services through its proprietary, multi-asset, and multi-currency technology platform to the financial markets worldwide. The company's Market Making segment principally consists of market making in the cash, futures, and options markets across equities, options, fixed income, currencies, and commodities.

Featured Story: What is the outlook for the FAANG stocks?